Access the full WAEC Financial Accounting Questions and Answers 2025 (OBJ & Essay) here. This page will be updated with verified solutions to both Objective and Essay sections before the exam begins. Refresh this page regularly to get the latest Financial Accounting answers as they drop.

WAEC Financial Accounting OBJ 2025

01-10: BBACABCDAC

11-20: AAABDABCCC

21-30: CADCDDCAAA

31-40: CCBCDCBABB

41-50: ACDACADDBB

COMPLETED!!!

WAEC Financial Accounting Essay 2025

Number 1

(1a)

-Surplus-

matches with Net profit

-Accumulated fund-

matches with Capital

-Receipts and payments account-

matches with Cash book

Deficit-

matches with Net loss

-Income and expenditure account-

matches with Profit and loss account

(1b)

(i)Purpose: Social clubs are non-profit organizations focused on member benefits, while limited liability companies (LLCs) aim to generate profit.

(ii)Capital: Social clubs usually have an accumulated fund, while LLCs have capital invested by owners.

(iii)Surplus/Deficit: Social clubs record surplus or deficit, while LLCs record net profit or net loss.

(iv)Ownership: Social clubs are owned by members, while LLCs are owned by shareholders or members.

(v)Financial Statements: Social clubs prepare income and expenditure accounts, while LLCs prepare profit and loss accounts.

==================

Number 2

(2ai)

-Seller-

Record of Sale:

(i)It serves as proof of a sale transaction, documenting the goods or services sold, quantity, price, and date.

(ii)It serves as an invoice to a formal request for payment from the buyer, specifying the amount owed and payment terms.

(iii)It helps track inventory levels by showing what items have been sold, aiding in stock management.

(2aii)

-Buyer-

(i)It serves as proof of purchase, useful for warranties, returns, and exchanges.

(ii)An invoice is a record of the amount owed and the payment terms, aiding in budgeting and financial planning.

(iii)It helps track business expenses for accounting and tax purposes.

(2b)

(i)Improved Organization:

Separating the ledger into classes (e.g., sales, purchases, assets, liabilities) improves organization and makes it easier to find specific information.

(ii)Enhanced Accuracy:

Dividing the ledger reduces the risk of errors by categorizing entries, making it easier to audit and reconcile accounts.

(iii)Better Analysis: Different classes of ledgers allow for more detailed financial analysis, helping businesses understand their performance in various areas.

==================

Number 3

(3)

(i)Purpose: Private company financial statements focus on profit and shareholder value, while government statements prioritize accountability, transparency, and public service delivery.

(ii)Reporting Standards: Private companies often use International Financial Reporting Standards (IFRS) or local GAAP. Government entities may use specific public sector accounting standards, such as IPSAS.

(iii)Users: Private company reports are primarily used by investors and creditors. Government reports are for citizens, oversight bodies, and other government agencies.

(iv)Focus: Private company statements emphasize profitability and financial performance. Government statements highlight budget compliance, service effectiveness, and fund management.

(v)Accounting basis: Private companies often use the accrual basis, while government entities may use modified accrual or cash basis, depending on the jurisdiction.

==================

Number 4

(4a)

Increase in provision for doubtful debts; This represents an increase in the estimated amount of money that a business expects it will not be able to collect from its debtors (customers who owe money).

-Treatment in final- accounts:

(i)Profit and Loss Account: The increase is treated as an expense and debited to the profit and loss account, reducing net profit.

(ii)Balance Sheet: The increase is added to any previous provision for doubtful debts and deducted from the total debtors balance to show the net realizable value of the debts.

(4b)

Decrease in provision for doubtful debts; This indicates a reduction in the estimated amount of uncollectible debts, meaning the business now expects to recover more from its debtors than previously anticipated.

-Treatment in final- accounts:

(i)Profit and Loss Account: The decrease is treated as a gain or a reduction in expense and is credited to the profit and loss account, increasing net profit.

(ii)Balance Sheet: The decrease is deducted from the existing provision for doubtful debts, leading to a smaller reduction from the total debtors balance.

(4c)

Provision for discount on debtors; This is an allowance made for potential discounts that might be given to debtors for early or prompt payment. It acknowledges that not all debtors may pay the full amount.

-Treatment in final accounts-

(i)Profit and Loss Account: This provision is treated as an expense and is debited to the profit and loss account.

(ii)Balance Sheet: The amount provided is deducted from the debtors balance.

(4d)

Provision for discount on creditors; This is an allowance made for potential discounts that might be received from creditors for early or prompt payment. It acknowledges that the business might not have to pay the full amount owed.

-Treatment in final accounts-

(i)Profit and Loss Account: This provision is treated as a gain and is credited to the profit and loss account.

(ii)Balance Sheet: The amount is deducted from the creditors balance.

(4e)

Provision for depreciation; Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It reflects the reduction in the asset’s value due to wear and tear, usage, or obsolescence.

-Treatment in final accounts-

(i)Profit and Loss Account: Depreciation is treated as an expense and is debited to the profit and loss account.

(ii)Balance Sheet: The accumulated depreciation is shown as a deduction from the cost of the asset, reflecting its net book value

==================

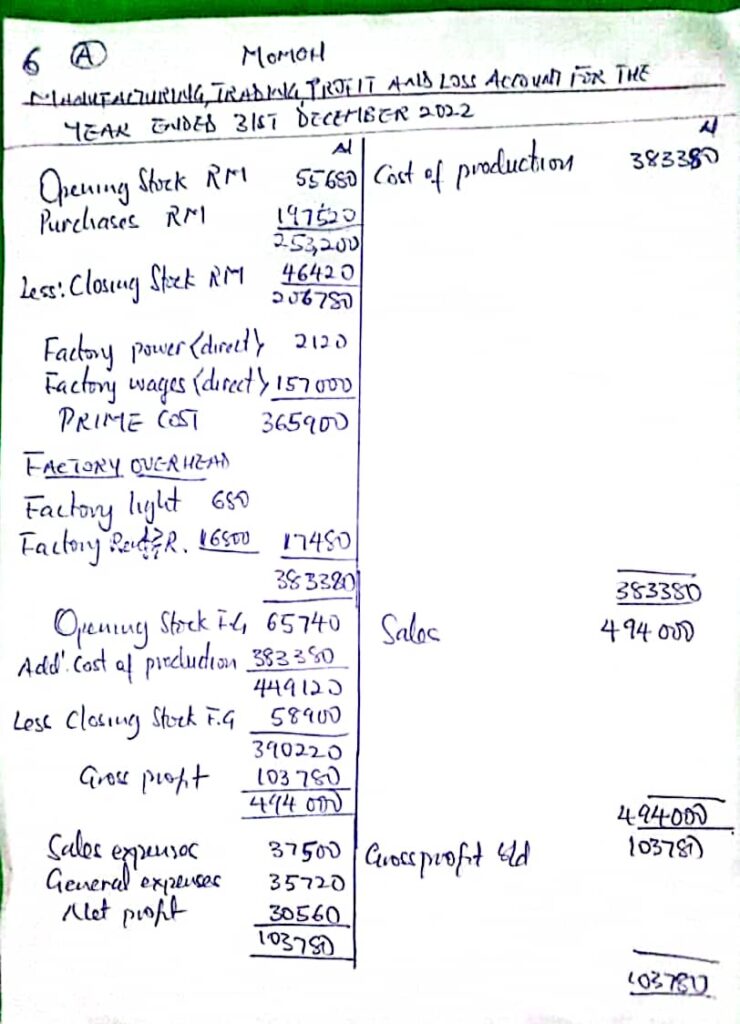

Number 6

==================

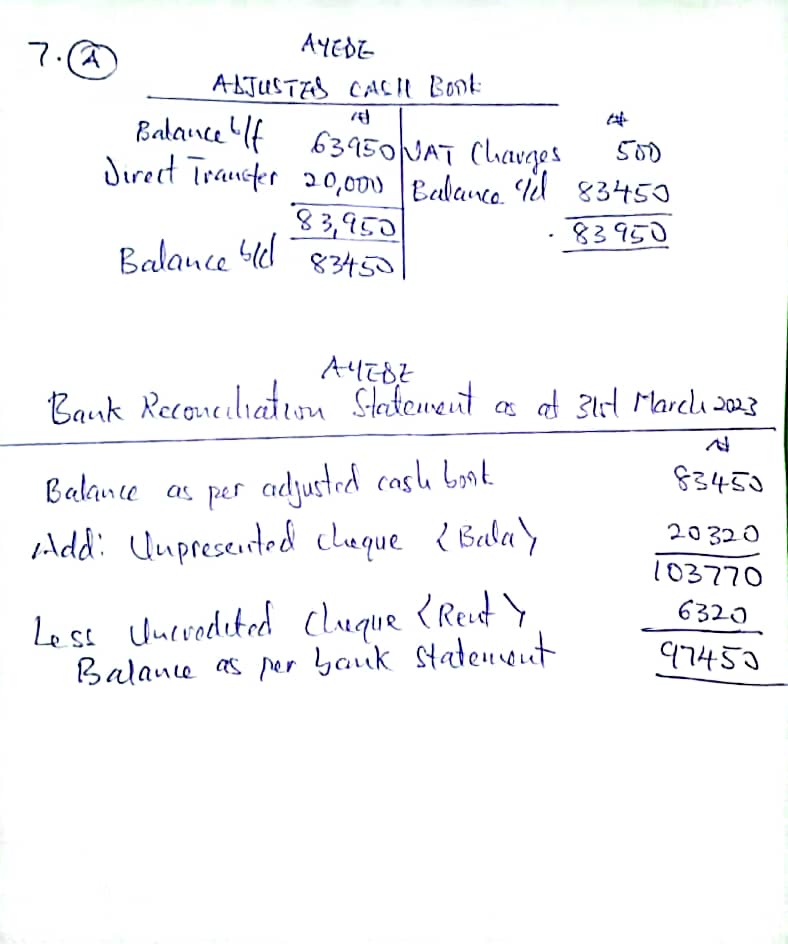

Number 7

==================

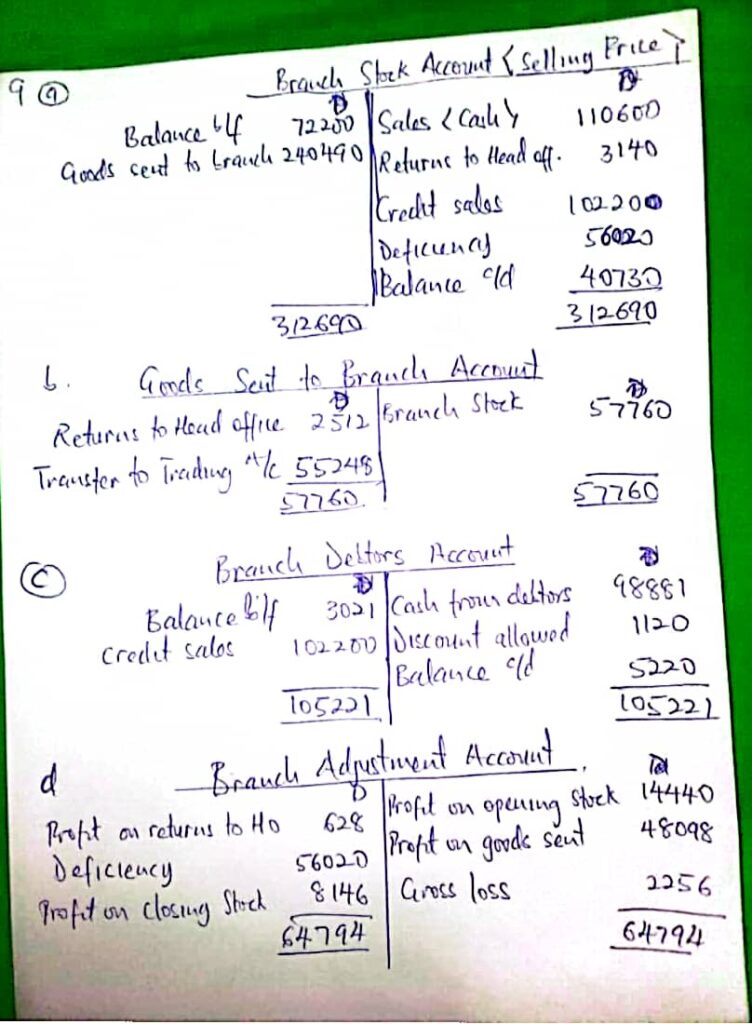

Number 9

COMPLETED!!!