Access the full WAEC Economics Questions and Answers for 2025 here. This page will be updated with verified solutions to both Objective (OBJ) and Essay (Theory) questions before the exam begins.

We are committed to providing accurate and reliable answers to help you prepare effectively. Make sure to refresh this page regularly as we update it with the latest WAEC Economics 2025 answers. Stay tuned and don’t miss out.

WAEC ECONOMICS OBJ 2025

MPORTANT NOTICES: IF YOUR QUESTIONS ARE RESHUFFLED OR DIFFERENT, PLEASE USE THE UNDERLINED ANSWERS FROM THE UPLOADED IMAGE TO IDENTIFY OR TRACE YOUR ANSWERS. ALTERNATIVELY, YOU CAN USE THE BEST CORRECT OPTIONS WE’VE SELECTED TO TRACE OR IDENTIFY YOUR ANSWERS IF YOUR QUESTIONS ARE DIFFERENT OR RESHUFFLED. THIS WILL HELP YOU ACCURATELY IDENTIFY OR TRACE YOUR ANSWERS DESPITE ANY RESHUFFLING AND AVOID ERRORS. THANK YOU!.

1.indirect taxes.

2.buying more raw materials.

3.high degree of uncertainty.

4.offer more than one product from various sectors for export.

5.higher than marginal revenue.

6.balance of payments.

- inferior goods

- average cost curve

- S

- average fixed cost

- gives incentives for innovation

- Its holders are creditors to the company

- Complete independence of each nation

- Capital account section

- buying more at a higher price

- C. fixing production quotas for all member countries.

- peasant farming.

- legally exploit the loopholes in tax laws to pay less tax.

- Shareholders’ funds.

- rice has a greater opportunity cost of production than maize.

- price inelastic.

- structural unemployment.

- specific tax.

- consume less to increase marginal utility.

- cause the value of money to rise

- has few substitutes

- central planning committee

- R

- technical economies

- reducing or removing export duties

- source of raw material

- Consumers income level

- lower than proposed expenditure

- vertically sloped

- it is recognized as a corporate entity

- decreases

- geographical mobility of labour

- subsidy on farm equipment has increased

- real composition of output is not fully known

- resources are inadequate

- Promissory notes

- an increase in equilibrium quantity while equilibrium price is fixed

- its total surface area cannot be changed

- Component bar chart

- shut down completely

- supply of goods to decrease

- marginal product of the variable factor rises and later falls

- encourage cassava farmers

- unemployment in the importing country

- inclusion of wages of house-keepers

COMPLETED!!!

WAEC ECONOMICS Essay 2025

Number 1

(1a)

Equilibrium Price = Pₛ

Equilibrium Output = Q𝘸

(1b)

The AR = MR curve represents the market’s demand curve.

(1c)

The firm is operating in a perfectly competitive market and experiencing economic loss in the short run.

Reason: In perfect competition,

Average Revenue (AR) = Marginal Revenue (MR)= Equilibrium Price = Demand

(1di)

Total Revenue = Pₛ × Q𝘸

This is represented by the area of the rectangle OPₛLQ𝘸O

(1dii)

Total Cost = Pᵤ × Q𝘸

This is represented by the area of the rectangle OPᵤJQ𝘸O

(1diii)

Loss = (Pᵤ – Pₛ) × Q𝘸

This is represented by the area of the rectangle PₛPᵤJQ𝘸Pₛ

(1e)

The firm is experiencing short-run losses. If this persists, it may shut down to prevent further losses. If many firms exit, market supply decreases, potentially raising prices and helping surviving firms cover costs, moving the industry toward long-run equilibrium.

==================

Number 2

(2a)

Terms of Trade Formula = (Price Index of Exports/Price Index of Imports) × 100

2020:

Terms of Trade = (180/150) × 100 = 120%

2021:

Terms of Trade = (160/200) × 100 = 80%

(2bi)

Favourable:2020

Reason:

In 2020, the terms of trade index is 120 (greater than 100), meaning Country X could buy more imports for every unit of exports. This indicates a favourable trade position.

(2bii)

Unfavourable: 2021

Reason:

In 2021, the terms of trade index is 80 (less than 100), meaning Country X had to export more to import the same quantity of goods. This is an unfavourable trade position.

(2c)

(i) Decrease in export prices: The price index of exports fell, reducing the value of goods sold abroad.

(ii) Increase in import prices: The price index of imports rose, making imports more expensive for Country X.

(2d)

Current Account Balance = Balance of Trade + Balance of Invisible Trade

$812,500 = $4,062,500 + Balance of Invisible Trade

Balance of Invisible Trade = $812,500 – $4,062,500

Balance of Invisible Trade = -$3,250,000

Explanation: This negative balance implies that the value of services (such as tourism, insurance, banking, etc.) and income flows was a net outflow, meaning the country paid more for invisible items than it earned.

==================

Number 4

(4a)

Minimum price control refers to a government-imposed price floor, which sets the lowest legal price at which a good or service can be sold. It is usually set above the equilibrium price to ensure that producers receive a minimum level of income, especially in sectors like agriculture.

(4b)

(i) To protect farmers’ income:

Agricultural markets often face price volatility due to weather, pests, or global market shocks. A minimum price ensures that farmers earn a stable and fair income, preventing poverty in rural areas.

(ii) To encourage increased production:

Guaranteeing a minimum price incentivizes farmers to produce more, as they are assured of a return that covers their costs and yields profit.

(iii) To achieve food security:

By stabilizing farm incomes, farmers can remain in business and maintain continuous food production, which is vital for national food security.

(4c)

(i) Excess supply (surplus):

When the minimum price is set above equilibrium, quantity supplied exceeds quantity demanded, leading to unsold surplus. This surplus can be wasteful and costly to manage.

(ii) Government financial burden:

To prevent wastage, the government may have to buy the excess stock and store it, which requires significant public spending on storage, transportation, and maintenance.

(iii) Inefficiency and resource misallocation:

Producers may overproduce certain crops just to benefit from the guaranteed price, even if those crops are not in high demand. This can lead to inefficient use of land and resources.

==================

Number 5

(5a)

Production costs are the total expenses incurred by a firm in the process of producing goods or services. These include payments for raw materials, labor, machinery, energy, and other inputs required in the production process.

(5b)

Real costs refer to the opportunity costs of using resources in production, including both explicit and implicit costs. It represents the value of the next best alternative forgone WHILE Explicit costs are direct, out-of-pocket expenses paid by a firm for inputs such as wages, rent, and materials. These costs are easily measurable and recorded in financial statements.

(5c)

A fixed input is a resource whose quantity does not change with the level of output in the short run. It remains constant even if production increases or decreases. For example, a factory building is a fixed input because it is used continuously without adjustment during production. On the other hand, a variable input is a resource that changes directly with the level of output. As production increases, more of it is required. For instance, flour used in baking is a variable input because the quantity needed depends on how much bread is produced.

(5d)

(i) Total Cost (TC): The overall cost of production at a given level of output, which is the sum of fixed and variable costs.

(ii) Fixed Cost (FC): Costs that remain constant regardless of output level, such as rent and salaries of permanent staff.

(iii) Variable Cost (VC): Costs that vary with the level of output, like raw materials and hourly wages.

(iv) Marginal Cost (MC): The additional cost incurred by producing one more unit of output.

==================

Number 6

(6a)

A monopoly is a market structure where a single firm dominates the entire market, controlling the supply of a product or service with no close substitutes.

(6b)

(i) Barriers to Entry: High startup costs, patents, or government regulations can prevent new firms from entering the market.

(ii) Control of Resources: A single firm may own or control a crucial resource, limiting others’ ability to compete.

(iii) Government Intervention: Governments may grant exclusive rights or licenses to a single firm, creating a monopoly.

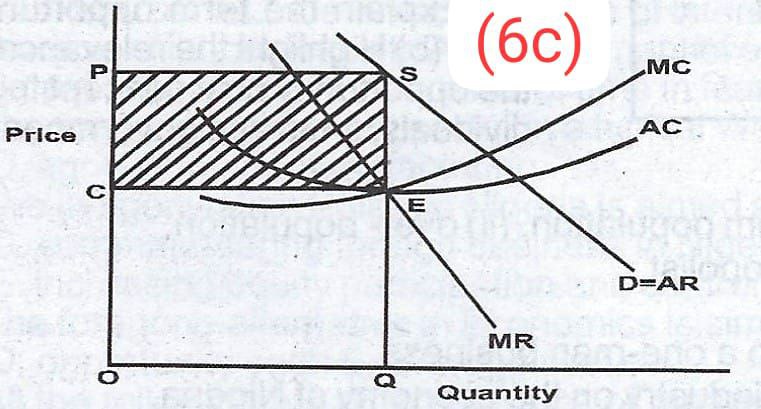

(6c)

A monopolist can earn supernormal profits due to their market power. In the diagram, the monopolist’s profit-maximizing output is where MR = MC. At this output, the price (P) is higher than the average total cost (ATC), resulting in supernormal profits (shaded area).

==================

Number 7

(7a)

(i) Treasury Bills: Short-term government securities used to finance government activities.

(ii) Commercial Paper: Short-term debt instruments issued by companies to raise funds for working capital.

(iii) Certificates of Deposit: Time deposits offered by banks with a fixed interest rate and maturity.

(7b)

(i) Money Market: A manufacturer will seek funds from the money market for short-term financing needs, such as managing working capital or covering temporary cash flow shortages. Example: A company needs to pay its suppliers within 30 days but is waiting for customer payments that will take 60 days. It might issue commercial paper to cover the short-term gap.

(ii) Capital Market: A manufacturer will seek funds from the capital market for long-term financing needs, such as funding expansion projects or purchasing new equipment. Example: A company wants to build a new factory that will take two years to complete and will be financed through the issuance of long-term bonds or equity shares.

(7c)

(i) Providing Long-term Finance: Development banks offer long-term loans and financing to support projects that contribute to economic development, such as infrastructure or industrial projects.

(ii) Promoting Economic Development: They play a crucial role in promoting economic growth by supporting sectors that are vital for development but may not be attractive to commercial banks due to high risks or long gestation periods.

(iii) Supporting Entrepreneurship and Innovation: Development banks often provide financial support to entrepreneurs and innovators, helping them launch new businesses or projects that can drive economic progress.

==================

Number 8

(8a)

A regressive tax system is one where lower-income individuals pay a higher proportion of their income in taxes compared to higher-income individuals.

(8b)

(i) Equity:

This principle states that taxes should be fairly distributed among citizens based on their ability to pay. It implies that those who earn more should pay more in taxes (vertical equity), and people with similar income should pay similar amounts (horizontal equity). The goal is to achieve fairness in the tax system.

(ii) Certainty:

The principle of certainty requires that tax rules must be clear and predictable. Taxpayers should know what to pay, when to pay, and how to pay. Uncertainty can lead to confusion, tax evasion, and disputes between the government and taxpayers.

(iii) Economy:

This means that the cost of collecting taxes should be as low as possible in relation to the revenue collected. A good tax system should not be wasteful; the government should avoid spending more on tax administration than the amount it generates in revenue.

(8c)

(i) Revenue Generation:

Taxes are the primary source of income for the government, used to fund public services like education, healthcare, roads, and security.

(ii) Redistribution of Wealth:

Taxation helps reduce income inequality by transferring resources from the rich to the poor through social welfare programs.

(iii) Regulation of the Economy:

Taxes can be used to control inflation, encourage investment, or discourage harmful activities.

==================

COMPLETED!!!