Access the full NECO Financial Accounting Answers for 2025 here. This page will be updated with accurate solutions to the objective, theory, and practice questions before the exam starts. Refresh the page regularly to see the latest answers.

NECO Financial Accounting OBJ Answers 2025

01-10: DCBCCEEDAB

11-20: CBDCBACCAD

21-30: CCBAECABCA

31-40: DBCCBBEECB

41-50: DAABEADEAA

51-60: DBAEEAEABA

COMPLETED!!!

NECO Financial Accounting Essay Answers 2025

Number 1

(1a)

Financial Accounting is the process of recording, summarizing, analyzing, and reporting the financial transactions of a business to provide an accurate picture of its financial performance and position.

(1b)

(PICK ANY FIVE)

(i) It is prepared on an accrual basis.

(ii) It records only revenue items, not capital items.

(iii) It is similar in format to a profit and loss account.

(iv) It shows surplus or deficit instead of net profit or loss.

(v) It relates only to a specific accounting period.

(vi) Non-cash items like depreciation are recorded.

(vii) It excludes capital receipts and payments.

(viii) Balances are not carried forward to the next year.

(ix) It helps determine the true financial performance of a non-profit organization.

(1c)

(PICK ANY FIVE)

(i) Error of omission.

(ii) Error of commission.

(iii) Error of principle.

(iv) Compensating error.

(v) Error of original entry.

(vi) Error of complete reversal of entries.

(vii) Error of duplication.

==================

Number 2

(2a)

(PICK ANY FIVE)

(i) Recording opening entries.

(ii) Recording closing entries.

(iii) Correction of errors.

(iv) Recording purchase or sale of fixed assets on credit.

(v) Recording transfer of items between accounts.

(vi) Recording dishonour of cheques or bills.

(vii) Recording adjustments like depreciation, provisions, etc.

(viii) Rectifying omission of transactions from subsidiary books.

(ix) Recording rare or infrequent transactions not suitable for other books.

(2b)

(PICK ANY FIVE)

(i) Locating errors in individual ledger accounts.

(ii) Reducing the volume of details in the general ledger.

(iii) Acting as a check on the accuracy of personal accounts.

(iv) Providing a summary of debtors and creditors.

(v) Facilitating quick preparation of final accounts.

(vi) Aiding in the detection of fraud.

(vii) Helping in reconciling balances of subsidiary ledgers.

(viii) Monitoring the movement of goods and payments.

(ix) Providing management with summarized information for decision-making.

(2c)

(PICK ANY FIVE)

(i) Invoice.

(ii) Receipt.

(iii) Debit note.

(iv) Credit note.

(v) Payment voucher.

(vi) Cheque counterfoil.

(vii) Bank statement.

(viii) Goods received note.

(ix) Cash memo.

==================

Number 3

(3ai)

Bad debts are amounts owed to a business by its customers that can no longer be collected because the customers have become insolvent, bankrupt, or are otherwise unable or unwilling to pay. Such debts are written off in the books as a loss because they reduce the income of the business. Bad debts are recorded as an expense in the income statement.

(3aii)

Reserves refer to portions of a business’s profits set aside for specific purposes or future uncertainties. These funds are kept aside to strengthen the financial position of the business and may be used for purposes such as expansion, replacement of assets, paying off debts, or absorbing future losses. Examples include general reserve, capital reserve, and revenue reserve.

(3aiii)

Consignment is an arrangement in which goods are sent by one person, known as the consignor, to another person, known as the consignee, who sells the goods on behalf of the consignor. Ownership of the goods remains with the consignor until the goods are sold. The consignee earns a commission for selling the goods but does not own them.

(3aiv)

An intangible asset is a non-physical asset that cannot be touched or seen but has value to the business. These assets provide future economic benefits and can include items like patents, copyrights, trademarks, goodwill, and software licenses. They are shown on the balance sheet under non-current assets and are usually amortized over their useful life.

(3av)

Fictitious assets are not real assets but rather expenses or losses that are carried forward and written off over future periods. They do not have any realizable value and do not represent actual resources. Examples include preliminary expenses, underwriting commission, and discount on issue of shares or debentures. They appear on the asset side of the balance sheet until fully written off.

(3b)

(PICK ANY FIVE)

(i) Sales journal.

(ii) Purchases journal.

(iii) Sales returns journal.

(iv) Purchases returns journal.

(v) Cash book.

(vi) Bills receivable book.

(vii) Bills payable book.

(viii) Journal proper.

(ix) Petty cash book.

==================

Number 4

(4a)

in a Tabular form

=Receipts and Payments Account=

(PICK ANY FIVE)

(i) It is prepared on a cash basis.

(ii) It records all cash receipts and payments irrespective of the period they relate to.

(iii) It includes both capital and revenue items.

(iv) It shows opening and closing cash balances.

(v) It does not show surplus or deficit.

(vi) It is like a summary of the cash book.

(vii) It is concerned only with actual cash transactions.

(viii) It has only one column each for receipts and payments.

(ix) It may record cash transactions relating to previous or future periods.

=Income and Expenditure Account=

(PICK ANY FIVE)

(i) It is prepared on an accrual basis.

(ii) It records only income and expenses for the current period.

(iii) It includes only revenue items.

(iv) It does not show cash balances.

(v) It reveals a surplus or deficit for the period.

(vi) It resembles a profit and loss account.

(vii) It includes adjustments for outstanding and prepaid items.

(viii) It is structured into income and expenditure sides.

(ix) It strictly records transactions belonging to the current accounting period only.

(4b)

(PICK ANY FIVE)

(i) Owners.

(ii) Investors.

(iii) Creditors.

(iv) Government.

(v) Management.

(vi) Employees.

(vii) Tax authorities.

(viii) Customers.

(ix) Financial analysts.

==================

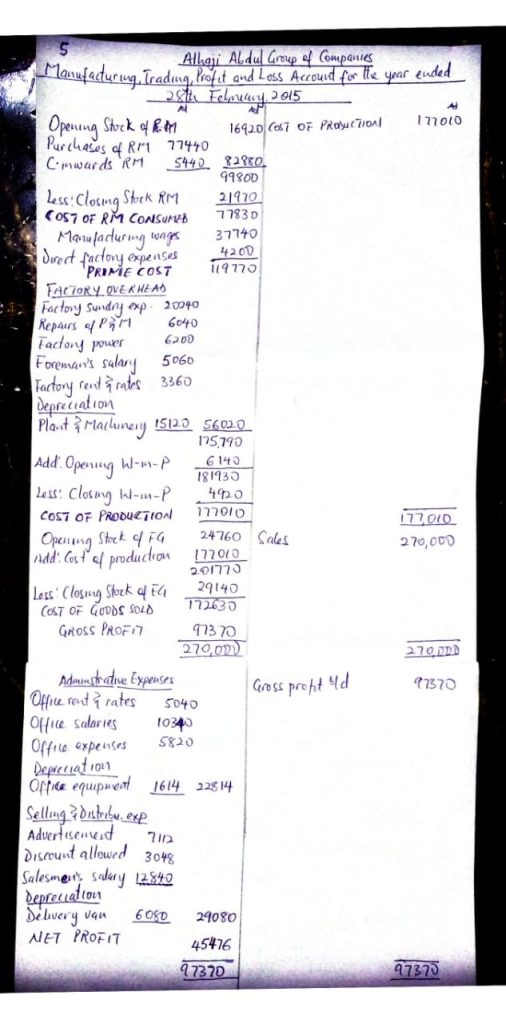

Number 5

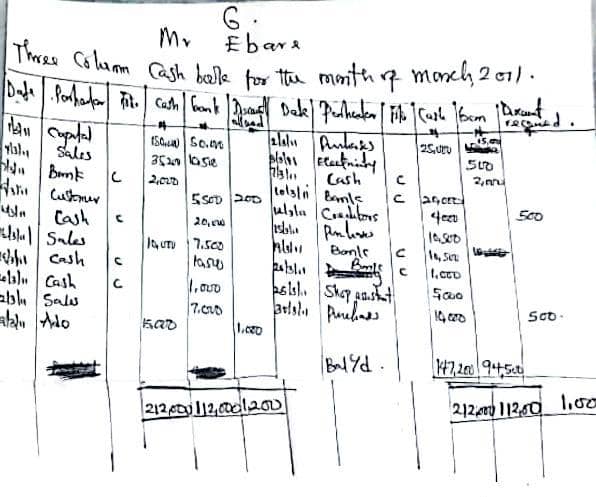

Number 6

==================

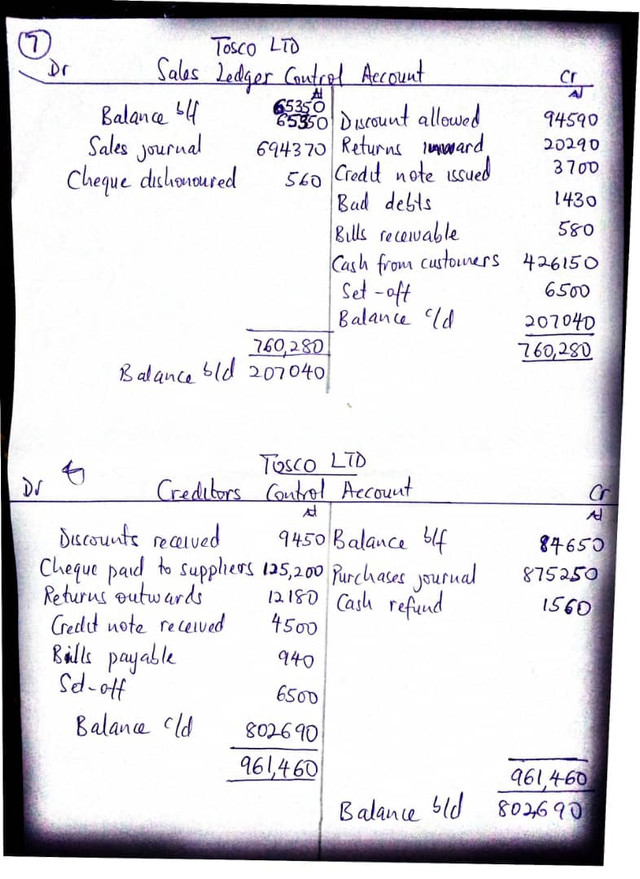

Number 7

==================

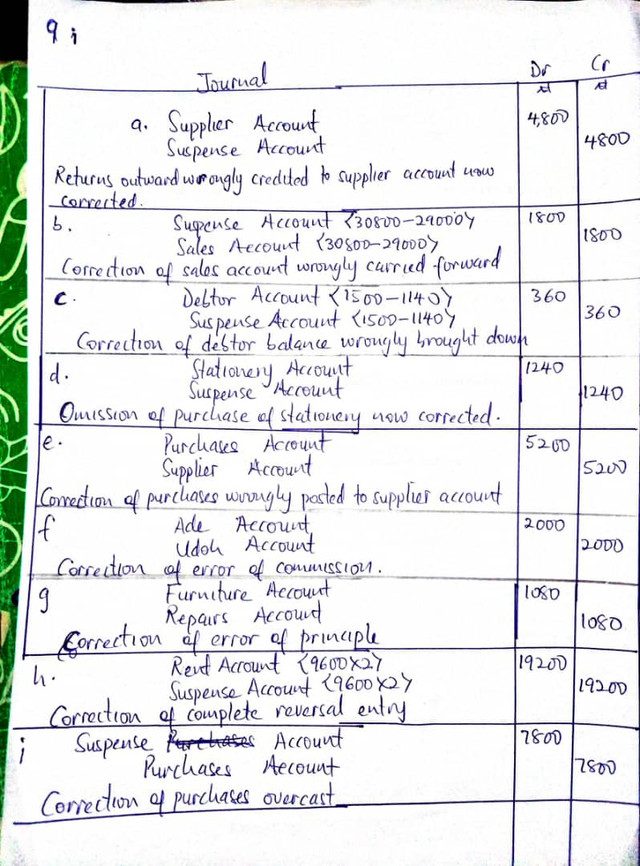

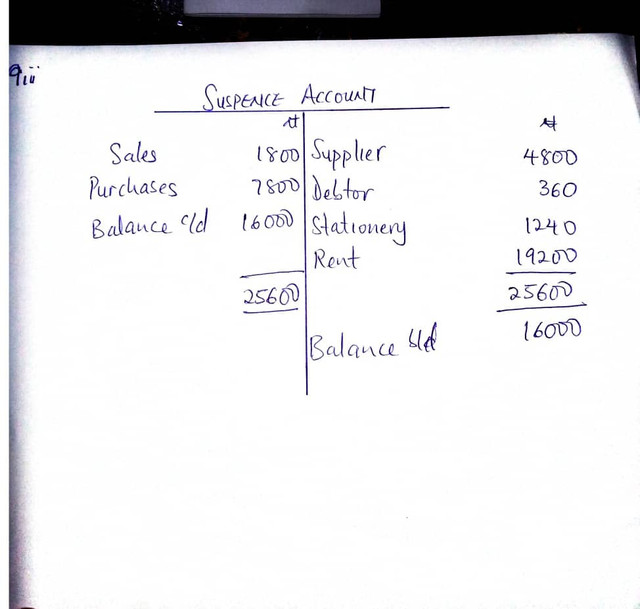

Number 9

COMPLETED!!!